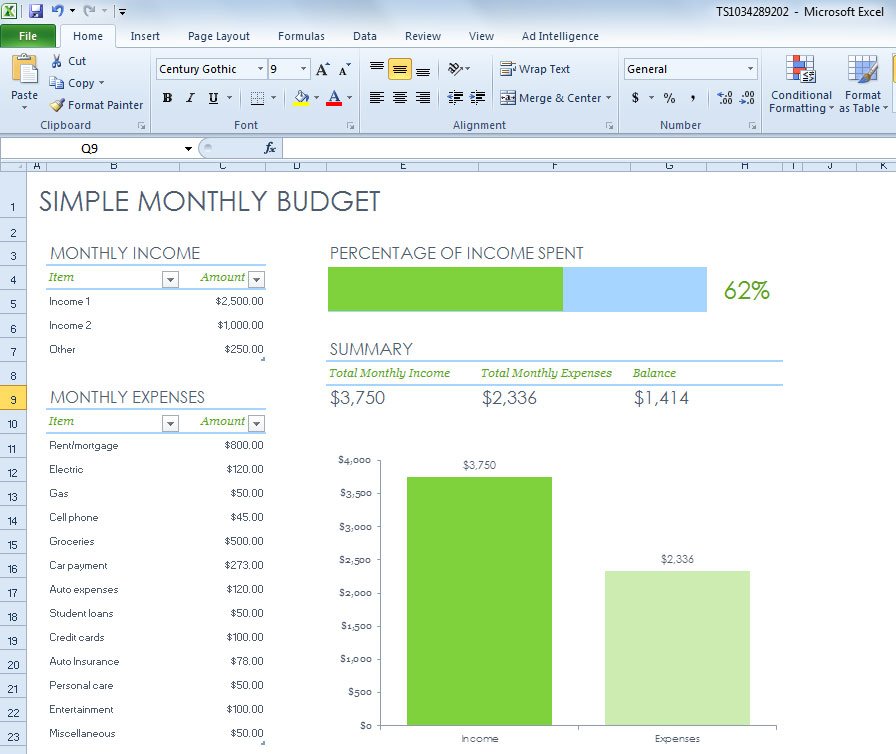

And I created two of them: one for a monthly budget, and the other for a weekly budget (if you get paid weekly). It works in Excel, Google Sheets, and Numbers. I recently put together an Excel template for budgeting that’s easy to understand, fill out, and download, so you can look at it whenever you want. Best Budget Templates for 2023 (Sneak Peek) Even when you fail, you win, because you are *actively* working on it and can pinpoint what went wrong!” So what’s the solution to get more people into budgeting? (including myself)īoom. They make you more confident, which in turn makes you sexier! By giving each of your dollars a mission you stay in control and write your story vs.

Who better to ask this question than the man himself-J. Second, it can get incredibly dull if you’re stuck sitting in front of your computer for hours on the weekend. Why so few? First, budgeting can get complex if you don’t have the right personal finance tools. What are the odds that the average person is deeply enamored with their highly detailed Excel spreadsheet of income and expense transactions? Not great.Īccording to a recent survey i, just 27% of US households prepare and follow a monthly budget. I’m a money nerd, and even I don’t love budgeting.

#EXCEL PERSONAL BUDGET MONTHLY EXAMPLE HOW TO#

Log in to your online account and export your spending data. Export data from bank or credit card company So without further ado, let’s look at how you can easily categorize and review actual spending. Plus, this gives you a great way to review each charge and know exactly what is going through your accounts. I’ve found instances where charges have been placed in the wrong bucket on several occasions. And some people use an online tool like Personal Capital to track and review spending. Some banks and credit card companies provide spending reports. This post will help with documenting your actual spending. It’s a tool you can use to regularly review spending habits + plan and budget several months out. This is a basic version of how I used to forecast as a finance analyst. This goes hand-in-hand with one of my very first posts on this blog: How to Develop a Personal Finance Forecast. I use this method for both personal and small business finances.

You may have charges you’ve been meaning to cancel or inaccurate charges from companies. And before you doze off or close the page 😉 - this will save you some precious time + give you a way to review your spending in detail on a regular basis. Today I’m sharing a really easy way to categorize spending with the use of Microsoft Excel Pivot Tables. I used to be a financial analyst and I’m also an excel geek at heart. Welcome! Why I am posting personal finance on a food blog? I wrote this post before I decided to focus mainly on food blogging.

0 kommentar(er)

0 kommentar(er)